Unlock growth with flexible digital banking solutions

Digital lending and banking solutions that adapt to your growth ambitions.

Unlock growth

with flexible

digital banking

solutions

Our established digital solutions serve banks, ASX-listed lenders and specialty finance providers, delivering outcomes at scale.

Our established digital solutions serve banks, ASX-listed lenders and specialty finance providers, delivering outcomes at scale.

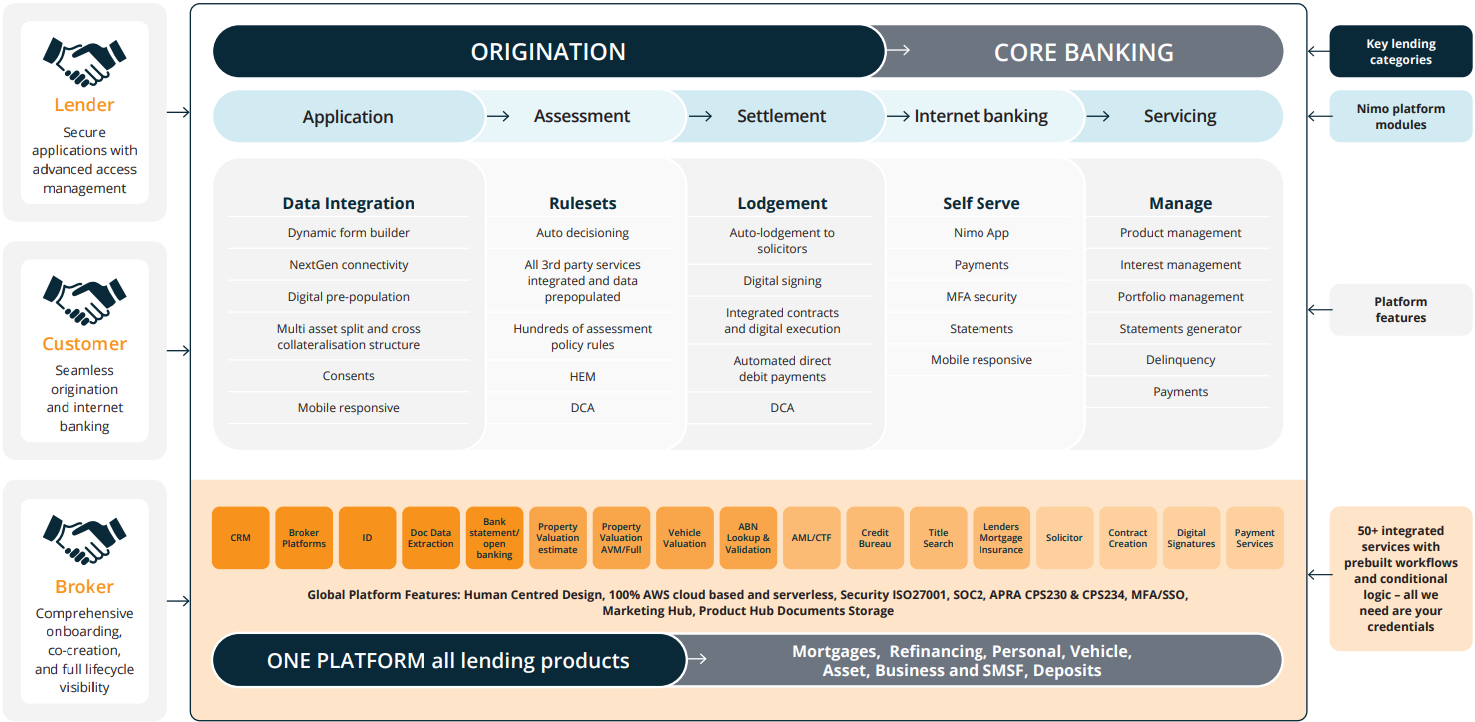

Complete banking infrastructure – Underlying workflows, controls and scalability needed for compliant, reliable banking operations.

Complex integrations – Managed integrations with third party services (valuations, ID verification, credit bureaus, solicitors, payments) on your behalf.

Decades of banking experience – Workflows, automation and decisioning tools refined through decades of digital banking experience.

Built for regulatory compliance – Aligned to APRA expectations, CPS 230/234, and supported by ISO27001 and SOC 2 certifications.

Origination

Fast and seamless digital applications from first capture to submission.

Core Banking

Modern core banking for loan servicing and digital banking.

Broker

Empower brokers with real-time tools and built-in automation.

TRUSTED BY

Modular solutions built by people with banking experience

Our solutions are shaped by decades of banking experience, not generic requirements gathering. Flexible SaaS modules to suit your rules and needs, without risk.

Application

Seamless customer onboarding with an AI-enabled loan application experience, powered by embedded APIs and real-time data exchange.

Assessment

Automated credit decisioning engine with policy-driven compliance, audit notes and referral workflows for deals that need a closer look.

Settlement

Settlement workflows that enable digital signing and contracts, manage solicitors and arrange disbursements, all in one place.

Internet Banking

Flexible, convenient and secure internet banking, with multi-factor authentication and built-in customer communications.

Product Management

Full product lifecycle management from a single interface, including pricing, rules, features and documentation.

Credit Control

Automated arrears management, hardship support, fee application and outbound communications.

Application

Seamless customer onboarding with an AI-enabled loan application experience, powered by embedded APIs and real-time data exchange.

Assessment

Automated credit decisioning engine with policy-driven compliance, audit notes and referral workflows for deals that need a closer look.

Settlement

Settlement workflows that enable digital signing and contracts, manage solicitors and arrange disbursements, all in one place.

Internet Banking

Flexible, convenient and secure internet banking, with multi-factor authentication and built-in customer communications.

Product Management

Full product lifecycle management from a single interface, including pricing, rules, features and documentation.

Credit Control

Automated arrears management, hardship support, fee application and outbound communications.

Embedded Services

Nimo is built to own the whole solution, integrating the capabilities lenders need to operate with efficiency, reduce total cost of ownership and maintain full control over data sovereignty. No need for additional vendors, third-party tools or hidden costs.

Integrations

Nimo offers over 50 pre-built integrations with automated workflows to accelerate time to market and reduce development costs. As integration experts, if you need something new, we can build it.

Digital Contracting

Fully integrated contracting experience, from secure customer portals and digital signing with NimoSign to solicitor handoff and settlement, all built into your lending workflow.

Communications

A fully integrated communications suite with secure, onshore delivery. Send SMS and email from your domain, with no external integrations, reducing cost, boosting engagement and ensuring data sovereignty.

Integrations

Nimo offers over 50 pre-built integrations with automated workflows to accelerate time to market and reduce development costs. As integration experts, if you need something new, we can build it.

Digital Contracting

Fully integrated contracting experience, from secure customer portals and digital signing with NimoSign to solicitor handoff and settlement, all built into your lending workflow.

Communications

A fully integrated communications suite with secure, onshore delivery. Send SMS and email from your domain, with no external integrations, reducing cost, boosting engagement and ensuring data sovereignty.

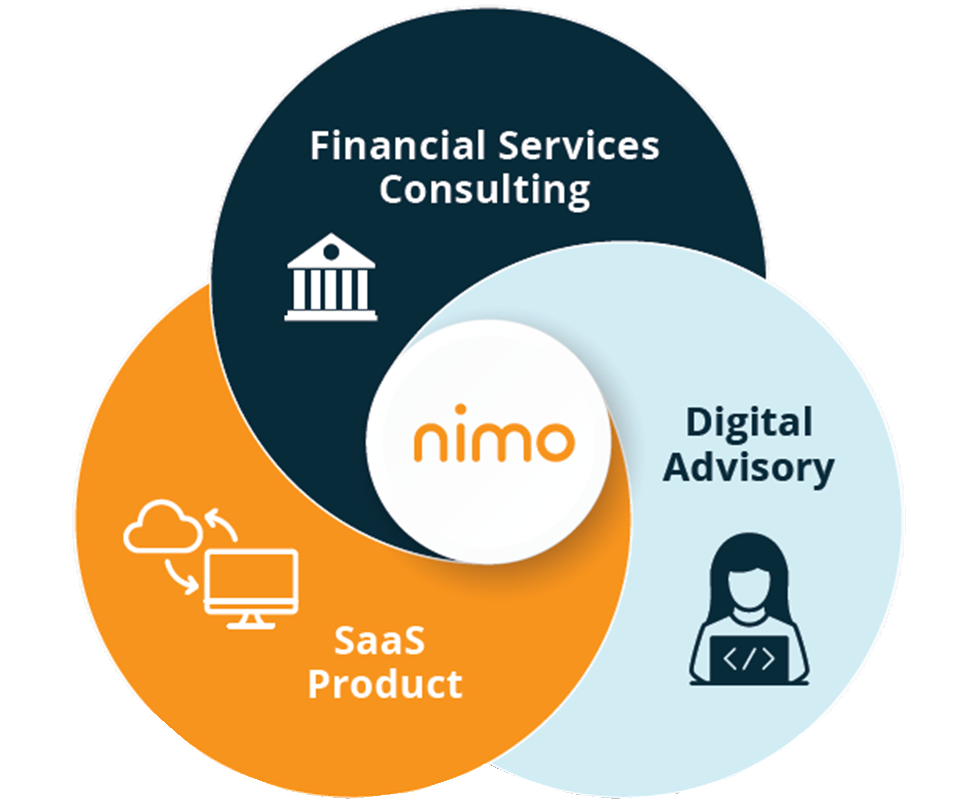

More than ‘just’ the platform

Nimo combines decades of experience in financial services and lending with deep digital expertise to transform how banks, lenders and brokers originate and manage credit.

Our consultants work closely with your teams to ensure successful adoption of Nimo as a practice management platform, driving operational efficiency and long-term value.

We provide expert advisory and online lending solutions that drive real transformation through strategic partnerships.

More than ‘just’ the platform

Nimo combines decades of experience in financial services and lending with deep digital expertise to transform how banks, lenders and brokers originate and manage credit.

Our consultants work closely with your teams to ensure successful adoption of Nimo as a practice management platform, driving operational efficiency and long-term value.

We provide expert advisory and online lending solutions that drive real transformation through strategic partnerships.

Complete banking software

A compliant, reliable banking ecosystem that scales automatically on demand.

Connect all your channels and customer experiences from day one, or expand in stages with modular rollouts that fit your strategy.

Why Nimo

Get started in weeks, not months

Nimo’s out-of-the-box, standalone platform is ready to go. No drawn-out discovery phases and build processes. Start delivering value, fast.

Strengthen compliance and reduce risk

Built-in regulatory and credit policy rules, and smart automation improve data accuracy and reduce manual rework, so every application meets your compliance standards.

Unlock same-day funding

Automate and optimise every step of the loan journey to reduce bottlenecks for a smoother process, accelerate approvals and enable same-day funding.

Accelerate business growth with confidence

Unlock modern lending experiences that scale with you, freeing up time to focus on strategic growth and customer success.

Delight customers and empower your teams

Give Customers, Lenders and Brokers a seamless digital experience with intuitive portals and real-time visibility into every stage of the lending journey.

Spend less on origination and credit management

Reduce total cost of ownership with shared service models and automation, improving operating expenses while meeting compliance requirements.

What our partners say

Matthew Dunnill

Chief Member Officer, The Mutual Bank

“Nimo’s efficiency, professionalism, and dedication to excellence have made the implementation of our new digital lending channel seamless and successful.

We are thrilled with the results and look forward to continuing our partnership with Nimo Industries.”

Sally Eales

Acting CEO, Central Murray Bank

“Nimo Loans has transformed the way we support our members at Central Murray Bank. By streamlining our lending processes, Nimo has significantly reduced processing times and delivered a faster, more seamless experience for our members.”

Richard Young

Co-founder and Co-CEO, Midkey

“What sets Nimo apart is its relentless focus on technology, automation, and user experience, which helps us, the lender and borrowers, navigate the mortgage process with ease. As Midkey scales, particularly with brokers, our partnership with Nimo will remain critical, enabling us to expand while maintaining the efficiency and service quality that our borrowers and brokers expect.”

Get started in weeks, not months

Nimo’s out-of-the-box, standalone platform is ready to go. No drawn-out discovery phases and build processes. Start delivering value, fast.

Strengthen compliance and reduce risk

Built-in regulatory and credit policy rules, and smart automation improve data accuracy and reduce manual rework, so every application meets your compliance standards.

Unlock same-day funding

Automate and optimise every step of the loan journey to reduce bottlenecks for a smoother process, accelerate approvals and enable same-day funding.

Accelerate business growth with confidence

Unlock modern lending experiences that scale with you, freeing up time to focus on strategic growth and customer success.

Delight customers and empower your teams

Give Customers, Lenders and Brokers a seamless digital experience with intuitive portals and real-time visibility into every stage of the lending journey.

Spend less on origination and credit management

Reduce total cost of ownership with shared service models and automation, improving operating expenses while meeting compliance requirements.

Award winning technology

2025 WINNER

5-Star Mortgage Innovator 2025

Australian Broker Awards

2025 WINNER

2 x Proptech Awards Categories

Proptech Australia

2024 WINNER

Excellence in Consumer Lending

Fintech Australia Awards

2023 WINNER

Best Home Loan Innovation

Australian Fintech Awards

5-Star Mortgage Innovator 2025 - Australian Broker

Excellence in Consumer Lending - Fintech Australia Awards

Best Home Loan Innovation - Australian Fintech Awards

2 x Category Finalists

4 x Category Finalists - Fintech Australia

Best Industry Service - Australian Mortgage Awards

Rising Star - Deloitte Fast 50